Renters Insurance Cost In Texas: Your Ultimate Guide to Affordable Coverage

Howdy, neighbor! If you've just moved to the Lone Star State or are thinking about renting a place, you've probably realized Texas is a fantastic place to live—but it comes with its own unique risks, from unpredictable hailstorms to strong coastal winds. Protecting your belongings is crucial, and that means getting renters insurance.

But let's face it: the big question isn't whether you need it, but how much it's going to cost you. You need a policy that fits your budget without compromising on protection. Understanding the exact Renters Insurance Cost In Texas requires knowing the averages and the specific factors that influence your premium.

Don't worry, we're here to break down the costs, explain what influences the price tag, and show you exactly how to snag the cheapest, yet most effective, policy possible. Spoiler alert: renters insurance is likely much more affordable than you think!

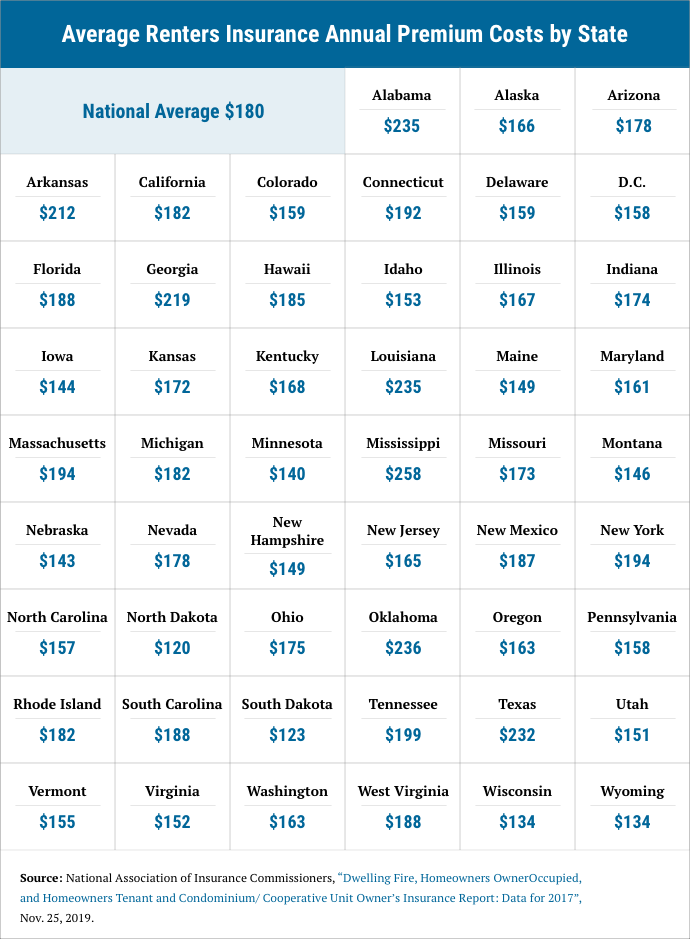

What Does Renters Insurance Cost In Texas on Average?

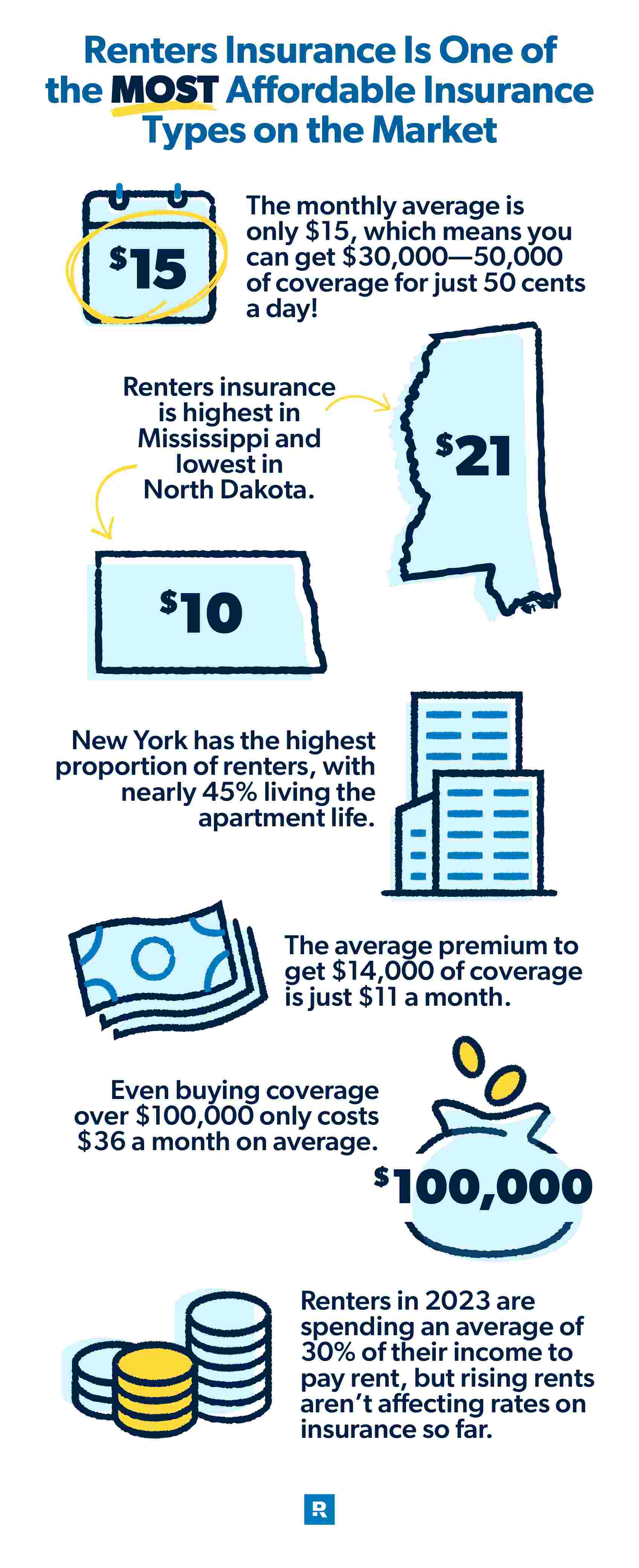

Good news! Renters insurance is one of the most budget-friendly forms of insurance available. For most Texans, the average Renters Insurance Cost In Texas hovers around $15 to $20 per month. That's about the price of two fancy coffees!

Annually, you can expect to pay between $180 and $240. This is significantly cheaper than homeowners insurance because you aren't paying to insure the physical structure of the building—that's your landlord's responsibility.

However, that figure is just an average. Your specific premium might be slightly higher or lower depending on where you live and the depth of coverage you choose. Let's dive into the specifics that make those numbers shift.

Key Factors That Drive Renters Insurance Cost In Texas

Insurance companies are masters of risk assessment. When calculating your premium, they look at several variables to determine how likely you are to file a claim. If you live in an area prone to severe weather or high crime, your rate will likely reflect that increased risk.

Location, Location, Texas Location

Living near the coast (like Galveston or Corpus Christi) often means higher premiums due to the increased risk of hurricanes and tropical storms. Similarly, areas with higher crime rates (theft risk) may see slightly elevated costs compared to rural or low-crime suburbs.

- Geographical Risk: Coastal areas face wind and flood risks (though flooding often requires a separate policy).

- Building Type: Newer buildings or those with robust fire suppression systems often qualify for lower rates.

- Crime Statistics: High theft rates in your specific zip code can increase the cost of your personal property coverage.

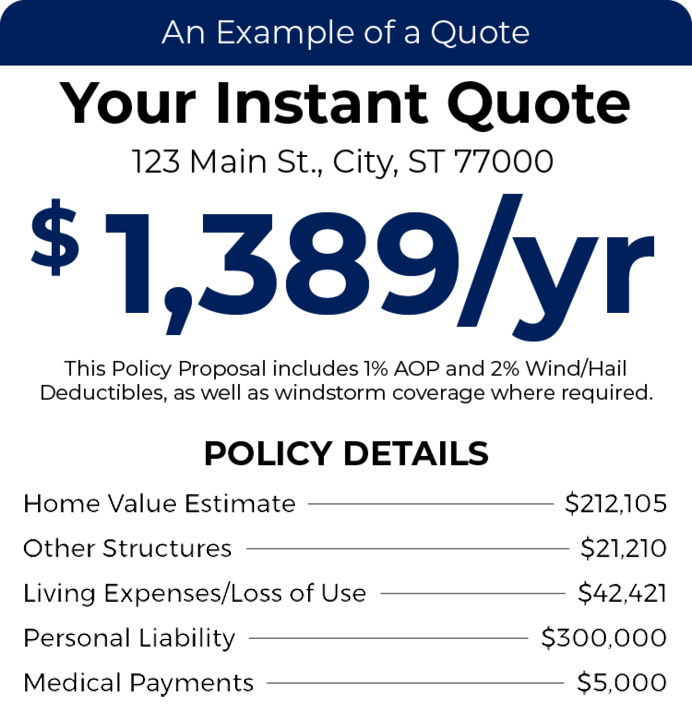

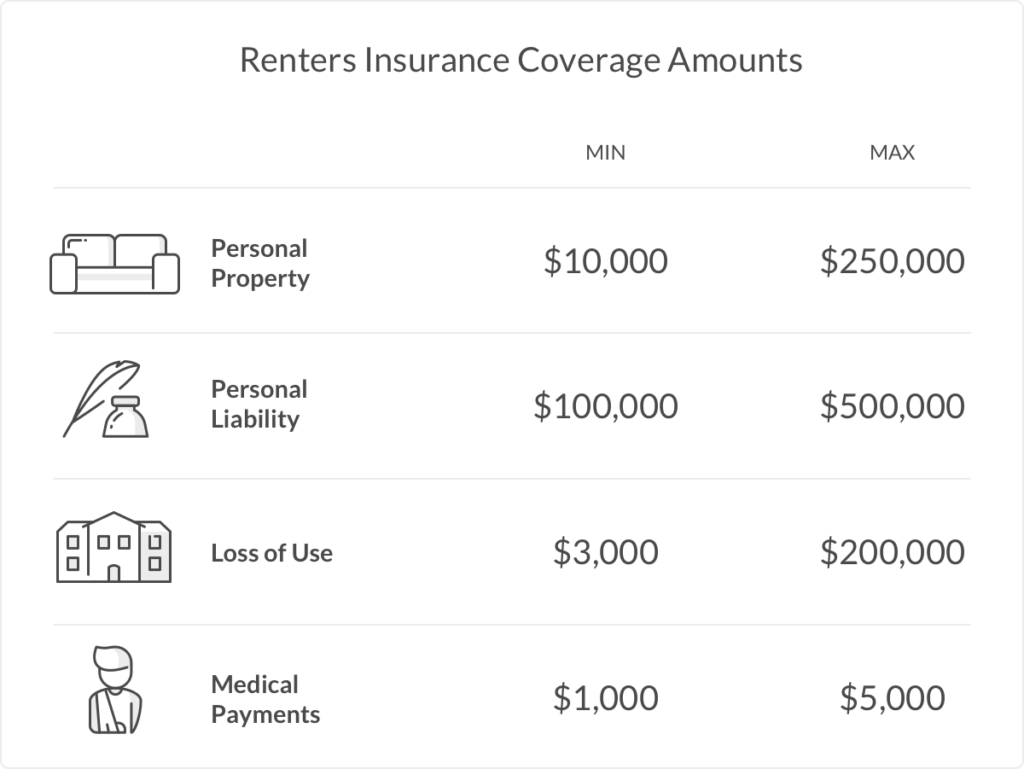

The Coverage Amount You Choose

This is the most direct factor affecting the price. If you have $50,000 worth of belongings, you will pay more than someone who only needs $15,000 in coverage. Be sure to inventory your possessions accurately so you don't overpay for coverage you don't need or under-insure yourself.

Furthermore, the amount of liability coverage you select matters. While $100,000 is standard, increasing it to $300,000 offers better peace of mind but will slightly bump up your annual premium.

Deductible Level and Credit Score

Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible (say, $1,000 instead of $500) lowers your monthly premium because you are assuming more risk. Most insurers in Texas, like many states, also use a credit-based insurance score to gauge risk, meaning an excellent credit score can secure you a better rate.

Smart Ways to Slash Your Texas Renters Insurance Premium

While the average Renters Insurance Cost In Texas is already low, there are several simple steps you can take to lower that monthly bill even further. Don't leave money on the table; leverage these discounts!

- Bundle Your Policies: This is often the biggest money saver. If you already have car insurance, bundling it with renters insurance from the same provider can save you 10% to 20% on both policies.

- Increase Your Deductible: If you have an emergency fund, raising your deductible from $500 to $1,000 or more can significantly reduce your premium, often saving you enough over a few years to cover that difference should you need to file a claim.

- Install Security Features: Do you have a burglar alarm, smoke detectors, or deadbolt locks? Many companies offer discounts for these protective measures. Make sure your insurer knows about them.

- Pay Annually: Paying your policy in one lump sum, rather than monthly installments, usually eliminates administrative fees and can net you a small discount overall.

- Shop Around Vigorously: Insurance rates vary dramatically between companies, even for identical coverage. Get quotes from at least five different providers to ensure you find the absolute best price for renters insurance cost in Texas.

Beyond Cost: What Protection Are You Buying?

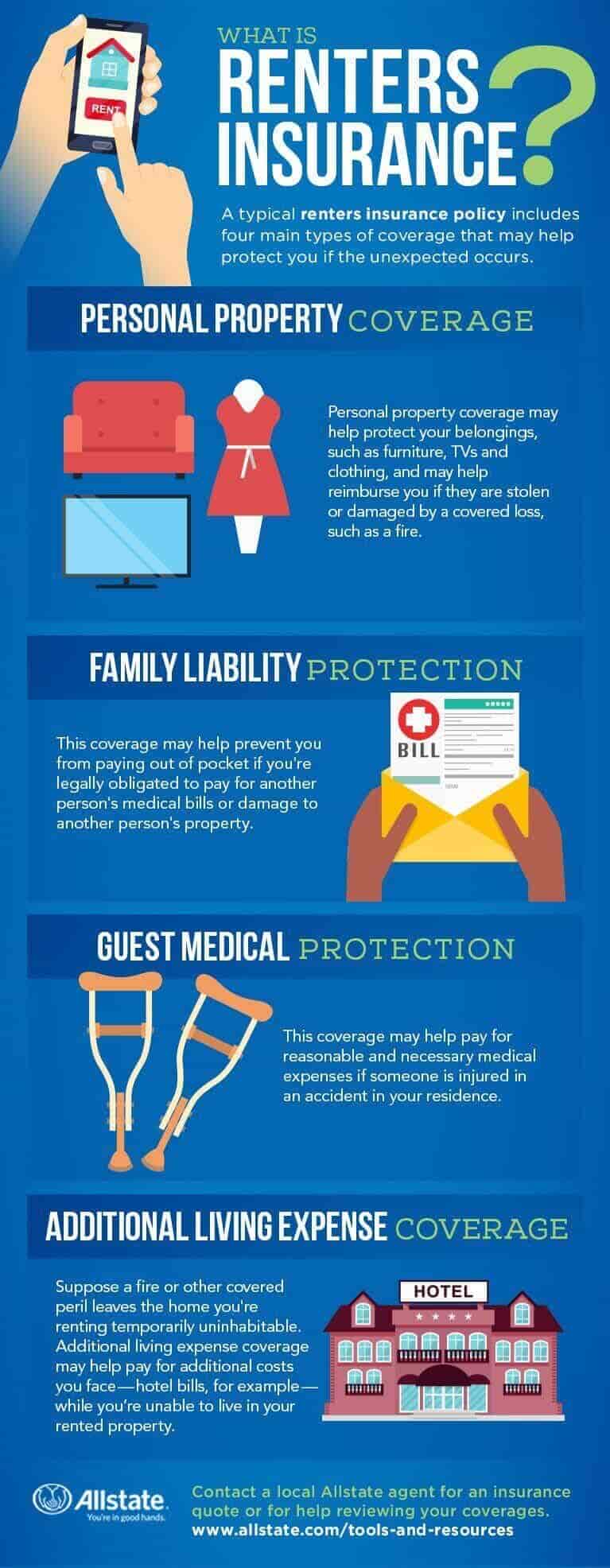

The low monthly cost is appealing, but the true value of renters insurance lies in the robust protection it offers. A standard Texas renters policy typically includes three main types of coverage, protecting you financially in nearly all non-flood disaster scenarios.

First, there is Personal Property coverage. This protects your possessions—everything from your couch and computer to your clothing—against "perils" like fire, theft, vandalism, and certain weather events. This coverage applies even if your property is damaged or stolen while you are traveling.

Second, Liability Coverage is arguably the most critical component. If someone is injured in your apartment or if you accidentally cause damage to the building (say, a kitchen fire), this coverage pays for the associated medical bills or repair costs. This protects you from potentially ruinous lawsuits.

Third, Loss of Use (or Additional Living Expenses, ALE) coverage helps you pay for temporary housing, food, and other increased costs if you have to move out because your rental unit is uninhabitable due to a covered claim.

RCV vs. ACV: Understanding Your Policy Payouts

Before signing your policy, make sure you understand the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV). This difference dramatically impacts how much money you receive after a covered loss.

- Actual Cash Value (ACV): This pays you the value of the item minus depreciation. If your five-year-old laptop is stolen, you receive the current used market price, which might not be enough to buy a replacement.

- Replacement Cost Value (RCV): This pays you the amount required to buy a brand-new version of the item, without factoring in depreciation. This type of policy provides superior protection and is highly recommended, even if it slightly increases your overall Renters Insurance Cost In Texas.

Spending an extra dollar or two per month for RCV coverage is usually worth the investment, ensuring you can truly replace your items after a devastating loss.

Conclusion: Finding the Right Renters Insurance Cost In Texas

The takeaway is clear: Renters Insurance Cost In Texas is incredibly affordable, typically costing less than $25 a month. For this small investment, you gain essential protection for your belongings and, critically, robust liability coverage that shields your future finances.

To find your best rate, always prioritize gathering multiple quotes, look for bundling discounts, and consider choosing a slightly higher deductible if you are comfortable with the risk. Don't wait until disaster strikes. Get covered today and enjoy the peace of mind that comes with knowing your Texas home and possessions are protected.

Frequently Asked Questions (FAQ) About Renters Insurance in Texas

- Does Texas law require me to have renters insurance?

- No, Texas state law does not mandate renters insurance. However, your landlord or property management company can legally require you to hold a valid policy as a condition of your lease agreement.

- Is flood damage covered by standard Texas renters insurance?

- Standard renters insurance policies explicitly exclude flood damage, including flash floods common in Central Texas. If you live in a flood-prone area, you must purchase a separate flood insurance policy, typically through the National Flood Insurance Program (NFIP).

- How much liability coverage should I get?

- While $100,000 is the minimum standard, most experts recommend increasing your liability coverage to $300,000. The cost increase is usually minimal, but the protection against a major lawsuit is vastly improved.

- Will my credit score affect my Renters Insurance Cost In Texas?

- Yes. Texas allows insurance companies to use a credit-based insurance score (which is different from your standard credit score) when calculating premiums. Generally, a better score leads to lower rates.

- What if I have expensive jewelry or art?

- Standard renters policies place limits (sub-limits) on high-value items like jewelry, firearms, or collectibles, often capping coverage at $1,500 to $2,500 per category. If you own items exceeding these limits, you should purchase a rider or scheduled personal property endorsement for full protection.

Renters Insurance Cost In Texas

Renters Insurance Cost In Texas Wallpapers

Collection of renters insurance cost in texas wallpapers for your desktop and mobile devices.

Vivid Renters Insurance Cost In Texas Scene in 4K

Transform your screen with this vivid renters insurance cost in texas artwork, a true masterpiece of digital design.

Breathtaking Renters Insurance Cost In Texas Moment Nature

Discover an amazing renters insurance cost in texas background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vivid Renters Insurance Cost In Texas Abstract Collection

Discover an amazing renters insurance cost in texas background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Renters Insurance Cost In Texas Design for Your Screen

Experience the crisp clarity of this stunning renters insurance cost in texas image, available in high resolution for all your screens.

Vivid Renters Insurance Cost In Texas Abstract Nature

Discover an amazing renters insurance cost in texas background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Captivating Renters Insurance Cost In Texas Abstract Photography

A captivating renters insurance cost in texas scene that brings tranquility and beauty to any device.

Artistic Renters Insurance Cost In Texas Design Collection

Immerse yourself in the stunning details of this beautiful renters insurance cost in texas wallpaper, designed for a captivating visual experience.

Crisp Renters Insurance Cost In Texas Image Illustration

This gorgeous renters insurance cost in texas photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Renters Insurance Cost In Texas Abstract Collection

Find inspiration with this unique renters insurance cost in texas illustration, crafted to provide a fresh look for your background.

Exquisite Renters Insurance Cost In Texas Abstract for Your Screen

Immerse yourself in the stunning details of this beautiful renters insurance cost in texas wallpaper, designed for a captivating visual experience.

Vibrant Renters Insurance Cost In Texas Artwork Concept

Experience the crisp clarity of this stunning renters insurance cost in texas image, available in high resolution for all your screens.

Vibrant Renters Insurance Cost In Texas Background for Your Screen

Explore this high-quality renters insurance cost in texas image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Renters Insurance Cost In Texas Design for Mobile

Transform your screen with this vivid renters insurance cost in texas artwork, a true masterpiece of digital design.

Breathtaking Renters Insurance Cost In Texas Design Collection

Transform your screen with this vivid renters insurance cost in texas artwork, a true masterpiece of digital design.

Amazing Renters Insurance Cost In Texas Design Concept

Transform your screen with this vivid renters insurance cost in texas artwork, a true masterpiece of digital design.

Breathtaking Renters Insurance Cost In Texas Background Concept

Discover an amazing renters insurance cost in texas background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Renters Insurance Cost In Texas Wallpaper Nature

Explore this high-quality renters insurance cost in texas image, perfect for enhancing your desktop or mobile wallpaper.

Mesmerizing Renters Insurance Cost In Texas Picture Digital Art

Explore this high-quality renters insurance cost in texas image, perfect for enhancing your desktop or mobile wallpaper.

Spectacular Renters Insurance Cost In Texas Design for Mobile

Find inspiration with this unique renters insurance cost in texas illustration, crafted to provide a fresh look for your background.

Gorgeous Renters Insurance Cost In Texas Picture for Your Screen

This gorgeous renters insurance cost in texas photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these renters insurance cost in texas wallpapers for free and use them on your desktop or mobile devices.