Target Premium Life Insurance: Your Guide to Smart Funding

Planning for the future often involves complex financial instruments, and few are as misunderstood as flexible premium life insurance policies. If you have a Universal Life (UL) or Variable Universal Life (VUL) policy, you've likely encountered the term "Target Premium Life Insurance." But what exactly does this target mean for your financial security?

It sounds crucial, and in many ways, it is. The target premium isn't a required payment; rather, it's a crucial benchmark calculated by your insurance company. Think of it as the perfect monthly contribution needed to keep your policy running smoothly until maturity, ensuring both the death benefit and potential cash value growth stay on track. Let's dive in and demystify the target premium so you can fund your policy like a pro.

What Exactly is Target Premium Life Insurance?

When we talk about the target premium, we are primarily referring to policies where you have payment flexibility, such as Universal Life (UL) policies. Unlike traditional Whole Life, where your premium is fixed, UL allows you to pay more or less than the target amount.

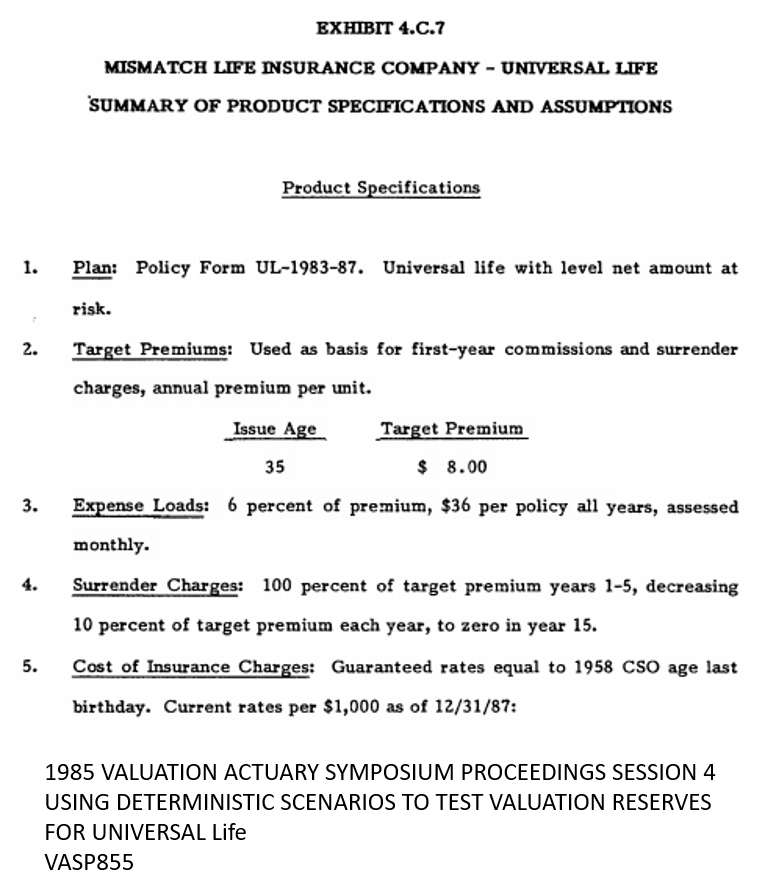

The target premium is essentially a projection. It represents the amount the insurer believes is necessary to cover all policy expenses—the cost of insurance (COI), administrative fees, and state premium taxes—while also allocating enough funds to the cash value component to ensure the policy remains solvent throughout your expected lifespan, based on current interest rate assumptions.

Crucially, this figure is calculated at the time the policy is issued and is based on a number of assumptions that might change over time, especially interest rate environments or the cost of insurance charges.

Target Premium vs. Minimum and Maximum Premiums

Understanding the target premium is much easier when you compare it to the minimum and maximum boundaries set by your insurer and the IRS. These three figures define the sandbox you can play in when funding your flexible premium policy.

The Minimum Premium: Keeping Your Policy Alive

The minimum premium is the lowest amount you can pay today to prevent your policy from lapsing immediately. This payment usually only covers the immediate cost of insurance and administrative fees for a short period. If you consistently pay only the minimum, the cash value of your policy will likely deplete quickly, meaning the policy may lapse sooner than intended.

Think of the cash value as a savings account that backs your insurance. Every time you pay your premium, it's broken down into several parts:

- Cost of Insurance (COI): Covers the actual death benefit risk.

- Administrative Fees: Management and operational costs.

- Cash Value Contribution: The remaining amount, which earns interest or is invested.

If your premium is too low, nothing is left over for that vital Cash Value Contribution, ultimately defeating the purpose of a permanent life insurance policy.

The Maximum Premium: Turbo-Charging Your Cash Value

On the flip side, the maximum premium is the highest amount you can pay into the policy without violating IRS tax rules. Specifically, the IRS sets limits to prevent life insurance policies from becoming illegal tax shelters, known as Modified Endowment Contracts (MECs).

Paying the maximum premium, especially early in the policy's life, can significantly boost the cash value growth, giving you greater long-term flexibility and access to funds. However, once a policy becomes a MEC, withdrawals and loans lose some of their favorable tax treatment, which is why working closely with an advisor is essential if you plan on maximizing contributions.

Why Does the Target Premium Matter for Your Policy?

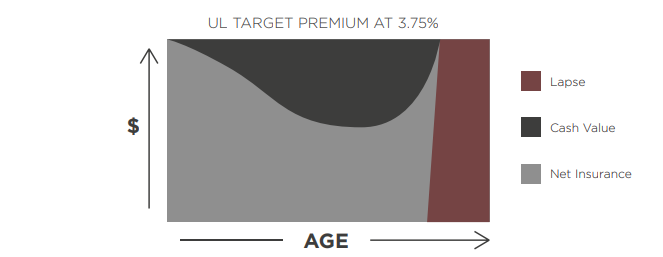

While paying less than the target premium won't make your policy lapse tomorrow, consistently underfunding it is a long-term risk. The target premium is the sweet spot; it's the premium designed to guarantee the policy stays alive until maturity, assuming the illustrated interest rates hold true.

If you pay exactly the target premium for your Target Premium Life Insurance policy, you are giving the policy the best chance to perform exactly as illustrated when you first purchased it. This stability is the core reason the target is so important for those prioritizing longevity over immediate cash value growth.

Here are the core benefits of adhering to the target premium:

- Long-Term Stability: It minimizes the risk of the policy lapsing in old age, even if interest rates perform moderately.

- Tax Efficiency: It ensures that enough capital goes into the cash value without risking classification as a Modified Endowment Contract (MEC).

- Financial Predictability: By meeting the target, you know roughly how much cash value will accumulate by a certain date (based on current illustrations), making future planning easier.

Common Misconceptions About Target Premium Life Insurance

The term "target" sometimes implies a requirement, leading to unnecessary confusion among policyholders. Let's clarify a couple of key misconceptions about this payment structure.

Is the Target Premium a Requirement?

No, the target premium is not a mandatory payment. Unlike a fixed-premium policy where missing a payment means lapsing, Universal Life policies allow you to skip payments entirely, as long as your existing cash value is sufficient to cover the monthly COI and fees.

However, while you have the flexibility to skip or reduce payments, remember that the cash value acts as a buffer. If you stop paying premiums entirely, your policy essentially begins paying for itself out of the cash value. Once that cash value reaches zero, the policy lapses.

Does Paying the Target Premium Guarantee Growth?

Paying the target premium helps ensure that your cash value grows, but it doesn't guarantee a specific rate of return. The growth of your policy's cash value is inherently tied to market performance (in VUL policies) or the insurer's crediting rate (in traditional UL policies).

If interest rates fall significantly below the illustrated rate, or if the cost of insurance charges increases over time (which they often do as you age), the target premium might no longer be sufficient to keep the policy solvent until maturity. This is why regular policy reviews are critical, especially for Target Premium Life Insurance structures.

Strategies for Funding Your Policy Effectively

Since the target premium is flexible, you can optimize your contributions based on your current financial situation and long-term goals. The key is balance: maximizing tax-deferred growth while maintaining policy stability.

If you have extra disposable income early on, consider "front-loading" the policy by paying significantly more than the target premium (up to the maximum premium). This increases the cash value quickly, allowing that money to compound sooner and potentially creating a large enough buffer that you could reduce or skip future payments if needed.

If your budget is tight, aim to meet the target premium whenever possible, and absolutely ensure you never fall below the calculated minimum. If you must skip a payment, view it as a temporary measure, and plan to catch up later by paying more than the target premium to rebuild your cash value buffer.

Always remember that the Target Premium Life Insurance requires active management. Review your annual statements, check how the current interest rate or investment performance compares to the illustration, and adjust your payments if necessary to maintain policy health.

Conclusion: Mastering Your Target Premium Life Insurance

The concept of "Target Premium Life Insurance" offers incredible flexibility, placing the power of policy funding directly in your hands. It is neither a fixed bill nor a guarantee of success, but rather a sophisticated guidepost designed to help you achieve the intended long-term results of your Universal Life coverage.

By aiming for the target premium, you ensure your policy covers its internal costs and maintains healthy cash value growth. By understanding the difference between the target, the minimum, and the maximum, you can strategically utilize your policy's flexibility—paying less during lean times and accelerating growth during prosperous years. Ultimately, managing your Target Premium Life Insurance effectively means staying informed and conducting regular policy performance reviews.

Frequently Asked Questions (FAQ) About Target Premiums

- What happens if I consistently pay less than the target premium?

- If you consistently pay less, your policy's cash value will accumulate slower than projected, or potentially decline. This increases the risk that the policy will lapse prematurely, particularly if interest rates drop or the cost of insurance increases significantly as you age.

- Is the target premium the same throughout the life of the policy?

- The target premium calculated at issue typically remains constant on paper. However, the actual premium required to keep the policy solvent changes constantly due to fluctuating COI charges (which rise with age) and interest rate performance. Therefore, while the initial "target" is fixed, the recommended funding level often changes.

- Can I pay the target premium in one lump sum?

- Yes, you can pay a large sum, often referred to as "dumping" money into the policy, as long as the total annual contribution does not exceed the IRS maximum (the guideline premium limit) that would trigger MEC classification. This is often an effective way to maximize early cash value growth.

- Is the target premium higher for older policyholders?

- Yes. Since the target premium is calculated to cover all costs and keep the policy solvent until maturity, older policyholders have higher mortality risk. Therefore, the Cost of Insurance (COI) component is much higher, resulting in a higher target premium compared to a younger person with the exact same coverage.

Target Premium Life Insurance

Target Premium Life Insurance Wallpapers

Collection of target premium life insurance wallpapers for your desktop and mobile devices.

Serene Target Premium Life Insurance View Photography

Experience the crisp clarity of this stunning target premium life insurance image, available in high resolution for all your screens.

Captivating Target Premium Life Insurance Background in HD

Find inspiration with this unique target premium life insurance illustration, crafted to provide a fresh look for your background.

Serene Target Premium Life Insurance Image Digital Art

Transform your screen with this vivid target premium life insurance artwork, a true masterpiece of digital design.

Detailed Target Premium Life Insurance Scene Nature

Explore this high-quality target premium life insurance image, perfect for enhancing your desktop or mobile wallpaper.

Beautiful Target Premium Life Insurance Moment Illustration

Transform your screen with this vivid target premium life insurance artwork, a true masterpiece of digital design.

Vibrant Target Premium Life Insurance View Nature

Discover an amazing target premium life insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Target Premium Life Insurance Picture Illustration

Explore this high-quality target premium life insurance image, perfect for enhancing your desktop or mobile wallpaper.

Stunning Target Premium Life Insurance Background for Desktop

Find inspiration with this unique target premium life insurance illustration, crafted to provide a fresh look for your background.

Vivid Target Premium Life Insurance Moment in 4K

Discover an amazing target premium life insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Amazing Target Premium Life Insurance Image in HD

Discover an amazing target premium life insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Target Premium Life Insurance Background in HD

This gorgeous target premium life insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Target Premium Life Insurance Scene Photography

This gorgeous target premium life insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Captivating Target Premium Life Insurance Image for Desktop

This gorgeous target premium life insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Artistic Target Premium Life Insurance Background Illustration

A captivating target premium life insurance scene that brings tranquility and beauty to any device.

Beautiful Target Premium Life Insurance Artwork for Desktop

Transform your screen with this vivid target premium life insurance artwork, a true masterpiece of digital design.

Vivid Target Premium Life Insurance Background Illustration

Experience the crisp clarity of this stunning target premium life insurance image, available in high resolution for all your screens.

Crisp Target Premium Life Insurance Photo in 4K

This gorgeous target premium life insurance photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Dynamic Target Premium Life Insurance Scene Illustration

Find inspiration with this unique target premium life insurance illustration, crafted to provide a fresh look for your background.

Detailed Target Premium Life Insurance Capture for Desktop

Transform your screen with this vivid target premium life insurance artwork, a true masterpiece of digital design.

Amazing Target Premium Life Insurance Capture for Your Screen

Discover an amazing target premium life insurance background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Download these target premium life insurance wallpapers for free and use them on your desktop or mobile devices.